-

États-Unis — Ratios de rémunération récents

Des PDG payés 1000 fois plus que l’employé médian

17 avril 2019

Philippe Orfali, Le Journal de MontréalLes entreprises américaines cotées en Bourse sont depuis peu obligées de dévoiler l’écart entre la paie de leur employé moyen et celle du PDG de la compagnie. Un gouffre de dizaines, voire de centaines de millions de dollars, qui fait sourciller.

Comme celle du PDG, la rémunération médiane des employés doit maintenant être incluse dans les rapports annuels des entreprises américaines.

-

Gouvernement d’entreprise aux États-Unis

Soif patronale de pouvoir et de contrôle de la dissidence

5 avril 2019

Dominique LemoineLe grand capital étasunien veut plus de réglementation, mais pas contre lui-même, plutôt contre les agents de changement.

-

É.-U.-d’A. — Début de la divulgation obligatoire du ratio

Are You Underpaid? In a First, U.S. Firms Reveal How Much They Pay Workers

March 11, 2018

Theo Francis,The Wall Street JournalAmerican workers, for the first time, are discovering how much employees earn at the biggest U.S. companies and how that pay compares with the chief executive’s.

At Humana Inc., the median employee made $57,385 while the CEO made 344 times that much, or $19.8 million, according to the health insurer’s proxy statement. Whirlpool Corp. says its median worker is a full-time staffer in Brazil earning $19,906 a year, while the CEO made an annualized $7.08 million, or 356 times as much. At medical-device maker Intuitive Surgical Inc., where the median employee was paid just over $157,000, the CEO got 32 times that, or $5.1 million.

-

Calcul et divulgation de ratios de rémunérations

Début d’un nouveau temps de conformité flexible aux États-Unis

24 octobre 2017

Dominique LemoineAprès de multiples tergiversations, il apparaît de plus en plus clair que la mise oeuvre de la version 2015 des règles présentées par la Securities and Exchange Commission (SEC) au sujet du calcul et de la divulgation de ratios de rémunérations deviendra une réalité à partir de 2018.

-

É.-U.-d’A. : Développement de la démocratie actionnariale en 2017

Shareholder Proposal Developments During the 2017 Proxy Season

Posted by Ronald O. Mueller and Elizabeth Ising, Gibson, Dunn & Crutcher LLP, on

Wednesday, July 12, 2017

Ronald O. Mueller and Elizabeth Ising are partners at Gibson, Dunn & Crutcher LLP. This post is based on a Gibson Dunn publication by Mr. Mueller, Ms. Ising, and Lori Zyskowski.

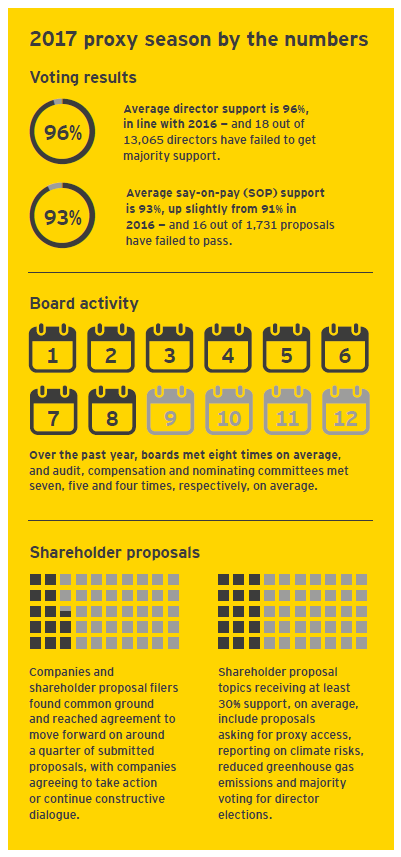

This post provides an overview of shareholder proposals submitted to public companies for 2017 shareholder meetings, including statistics and notable decisions from the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) on no-action requests.

I. Shareholder Proposal Statistics and Voting Results

A. Shareholder Proposals Submitted

1. Overview

For 2017 shareholder meetings, shareholders have submitted approximately 827 proposals, which is significantly less than the 916 proposals submitted for 2016 shareholder meetings and the 943 proposals submitted for 2015 shareholder meetings.

For 2017, across four broad categories of shareholder proposals—governance and shareholder rights; environmental and social issues; executive compensation; and corporate civic engagement—the most frequently submitted were environmental and social proposals (with approximately 345 proposals submitted).

The number of social proposals submitted to companies increased to approximately 201 proposals during the 2017 proxy season (up from 160 in 2016). Thirty-five social proposals submitted in 2017 focused on board diversity (up from 28 in 2016), 34 proposals focused on discrimination or diversity-related issues (up from 16 in 2016), and 19 proposals focused on the gender pay gap (up from 13 in 2016).

Environmental proposals were also popular during the 2017 proxy season, with 144 proposals submitted (up from 139 in 2016). Furthermore, there was an unprecedented level of shareholder support for environmental proposals this proxy season, with three climate change proposals receiving majority support and climate change proposals averaging support of 32.6% of votes cast. This compares to one climate change proposal receiving majority support in 2016 and climate change proposals averaging support of 24.2% of votes cast. As further discussed below, the success of these proposals is at least in part due to the shift in approach towards environmental proposals by certain institutional investors, including BlackRock, Vanguard and Fidelity.

-

É.-U.-d’A. : Revue des AAA 2017

2017 Proxy Season Review

Posted by Mark Manoff and Stephen W. Klemash, EY, on

Sunday, July 9, 2017

Mark Manoff is Americas Vice Chair and Stephen W. Klemash is a Partner with the EY Center for Board Matters. This post is based on a publication from the EY Center for Board Matters by Mr. Manoff and Mr. Klemash.

Amid regulatory and legislative uncertainty, investors remain committed to holding boards, and themselves, to higher levels of accountability, transparency and engagement. The 2017 proxy season is marked by the launch of a historic US stewardship code and the emergence of proxy access as standard practice across large companies.

These developments unite many leading investors behind common governance and stewardship principles and encourage other investors to take a more active approach to stewardship responsibilities. They also grant investors more influence over the companies they own.

Where’s the focus this year?

Board diversity and gender pay equity are key themes in 2017. Investors and boards recognize diversity as a critical element to enhancing board effectiveness and corporate talent agendas. Environmental sustainability is also increasingly in the spotlight, with many investors viewing companies’ approaches to climate risk management through the lens of long-term value creation. Some investors are challenging unequal voting structures and virtual shareholder meetings based on signals that those practices may be on the rise. Meanwhile, investor support for director elections and executive pay programs is holding strong as companies continue to enhance their investor communications—both in the proxy and through direct engagement.

This post is based on the EY Center for Board Matters proprietary corporate governance database and ongoing conversations with investors and directors. [1]

-

É.-U.-d’A. : La Chambre détruit Dodd-Frank

La loi Dodd-Frank (baptisée d’après les ex-sénateurs démocrates Barney Frank et Christopher Dodd) impose notamment des coussins de fonds propres aux grandes banques, des tests de résistance annuels et un processus de préparation à une éventuelle faillite.

La Chambre vote un projet de loi pour alléger la régulation financière

8 juin 2017

Agence France-Presse, La PresseWashington — La Chambre des représentants américains a voté jeudi un projet de loi qui détricote une bonne part des règlementations financières de la loi Dodd-Frank, adoptée après la crise de 2008.

Ce texte baptisé « Financial Choice Act » a réuni 233 voix contre 186 jeudi à la Chambre mais il doit encore passer devant le Sénat où il aura besoin de voix d’élus démocrates pour être adopté.

-

Au-delà du protectionnisme-spectacle…

Un régime industriel encore plus autoritaire que Trump?

27 janvier 2017

Dominique LemoineLes marchés boursiers d’Amérique du Nord ne se sont pas encore effondrés, comme l’anticipaient plusieurs, en cas d’élection de Donald Trump à la présidence avec son discours protectionniste.

-

Ouverture et réglementation de marchés

Nouvelles permissions et règles financières à venir

31 août 2015

Dominique LemoineDes développements en matière de réglementation financière sont en cours et s’inspirent mutuellement en Europe et en Amérique du Nord.

L’Office d’investissement du régime de pension du Canada (OIRPC) @cppinvestments abandonne son objectif d’atteinte de la carboneutralité en 2050 (net zero), après seulement 3 ans, en l’annonçant dans la section FAQ de son site web. https://t.co/lxMT6ssnF1 https://t.co/1B2LZyT93y pic.twitter.com/ctU3MAF2rW

— Le MÉDAC (@MEDACtionnaires) May 30, 2025

Des investisseurs institutionnels d’importance (950 milliard$ sous gestion) demandent que Musk travaille 40 h/sem. pour Tesla. Ils détiennent 0,25 % des actions de Tesla. https://t.co/ag87Tgkp7I

— Le MÉDAC (@MEDACtionnaires) May 29, 2025

BlackRock parie sur l’intérêt des investisseurs pour le secteur de la défense (en Europe…) en constituant un FNB indiciel. https://t.co/QNey6GoRs2

— Le MÉDAC (@MEDACtionnaires) May 29, 2025

« retirer des sommes de ses comptes de courtage imposables vers des [CELI] en générant ainsi artificiellement des pertes dans les premiers et des gains dans les seconds » — @lautorite https://t.co/gpPQdhi39s

— Le MÉDAC (@MEDACtionnaires) May 29, 2025

« Le remplacement de Bruce Guerriero et de Daniel Rabinowicz est réclamé […] La suppression de la structure à deux catégories d’actions est aussi revendiquée » https://t.co/2C4FI4U2RX

— Le MÉDAC (@MEDACtionnaires) May 23, 2025

Le nombre de propositions d’actionnaire concernant la gouvernance a diminué moins vite que les propositions d’actionnaire sur l’environnement, de 2018 à 2025, aux É.-U.-d’A., selon ISS. Dans l’ensemble, c’est un creux sur 8 ans. https://t.co/dAucnupAPw

— Le MÉDAC (@MEDACtionnaires) May 23, 2025