Revue de presse

Les autorités en valeurs mobilières du Canada publient des indications sur les opérations donnant lieu à un conflit d’intérêts

L’Autorité des marchés financiers

Toronto – Les autorités en valeurs mobilières de l’Ontario, du Québec, de l’Alberta, du Manitoba et du Nouveau-Brunswick (les « autorités participantes ») ont publié aujourd’hui l’Avis multilatéral 61-302 du personnel des ACVM, Examen du personnel et commentaires sur le Règlement 61-101 sur les mesures de protection des porteurs minoritaires lors d’opérations particulières.

Actions collectives portant sur les valeurs mobilières de la Société financière Manuvie

Montréal, le 14 juillet 2017 — Une entente de règlement a été conclue dans le cadre d’une action collective alléguant que la Société financière Manuvie (« SFM ») a faussement représenté la suffisance de ses pratiques de gestion du risque, et a omis de divulguer l’ampleur de l’exposition de la Société aux risques liés au marché des actions et aux taux d’intérêt.

La SFM a accepté de payer 69 000 000 $. L’entente de règlement constitue un compromis relativement aux réclamations, lesquelles sont contestées, et ne constitue pas une reconnaissance de responsabilité ou d’actes fautifs de la part de la SFM.

Le règlement a été approuvé par la cours la Cour supérieure de l’Ontario et la Cour supérieure du Québec (les « cours »). Les Cours ont nommé Crawford & Company et Garden City Group, LLC comme Administrateurs du règlement. Afin d’être éligible à un dédommagement, les membres du groupe doivent soumettre un Formulaire de réclamation dûment rempli à l’adresse ci-dessous, au plus tard le 9 octobre 2017 (le « délai de réclamation »), le cachet de la poste en faisant foi.

Shareholder Proposal Developments During the 2017 Proxy Season

Posted by , on

Wednesday, July 12, 2017

Ronald O. Mueller and Elizabeth Ising are partners at Gibson, Dunn & Crutcher LLP. This post is based on a Gibson Dunn publication by Mr. Mueller, Ms. Ising, and Lori Zyskowski.

This post provides an overview of shareholder proposals submitted to public companies for 2017 shareholder meetings, including statistics and notable decisions from the staff (the “Staff”) of the Securities and Exchange Commission (the “SEC”) on no-action requests.

I. Shareholder Proposal Statistics and Voting Results

A. Shareholder Proposals Submitted

1. Overview

For 2017 shareholder meetings, shareholders have submitted approximately 827 proposals, which is significantly less than the 916 proposals submitted for 2016 shareholder meetings and the 943 proposals submitted for 2015 shareholder meetings.

For 2017, across four broad categories of shareholder proposals—governance and shareholder rights; environmental and social issues; executive compensation; and corporate civic engagement—the most frequently submitted were environmental and social proposals (with approximately 345 proposals submitted).

The number of social proposals submitted to companies increased to approximately 201 proposals during the 2017 proxy season (up from 160 in 2016). Thirty-five social proposals submitted in 2017 focused on board diversity (up from 28 in 2016), 34 proposals focused on discrimination or diversity-related issues (up from 16 in 2016), and 19 proposals focused on the gender pay gap (up from 13 in 2016).

Environmental proposals were also popular during the 2017 proxy season, with 144 proposals submitted (up from 139 in 2016). Furthermore, there was an unprecedented level of shareholder support for environmental proposals this proxy season, with three climate change proposals receiving majority support and climate change proposals averaging support of 32.6% of votes cast. This compares to one climate change proposal receiving majority support in 2016 and climate change proposals averaging support of 24.2% of votes cast. As further discussed below, the success of these proposals is at least in part due to the shift in approach towards environmental proposals by certain institutional investors, including BlackRock, Vanguard and Fidelity.

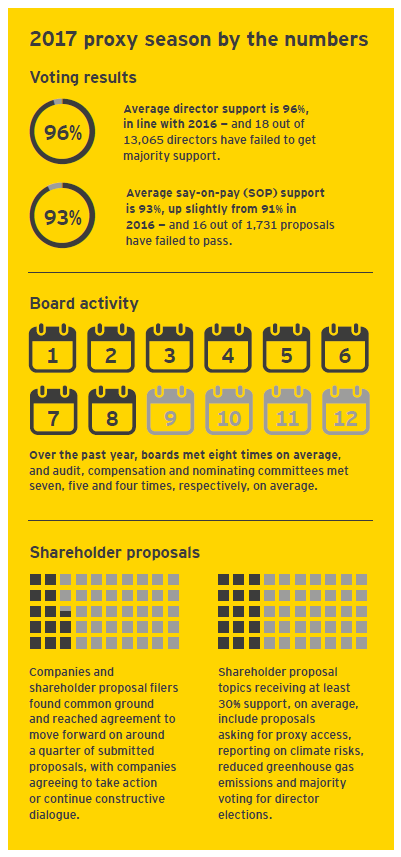

2017 Proxy Season Review

Posted by , on

Sunday, July 9, 2017

Mark Manoff is Americas Vice Chair and Stephen W. Klemash is a Partner with the EY Center for Board Matters. This post is based on a publication from the EY Center for Board Matters by Mr. Manoff and Mr. Klemash.

Amid regulatory and legislative uncertainty, investors remain committed to holding boards, and themselves, to higher levels of accountability, transparency and engagement. The 2017 proxy season is marked by the launch of a historic US stewardship code and the emergence of proxy access as standard practice across large companies.

These developments unite many leading investors behind common governance and stewardship principles and encourage other investors to take a more active approach to stewardship responsibilities. They also grant investors more influence over the companies they own.

Where’s the focus this year?

Board diversity and gender pay equity are key themes in 2017. Investors and boards recognize diversity as a critical element to enhancing board effectiveness and corporate talent agendas. Environmental sustainability is also increasingly in the spotlight, with many investors viewing companies’ approaches to climate risk management through the lens of long-term value creation. Some investors are challenging unequal voting structures and virtual shareholder meetings based on signals that those practices may be on the rise. Meanwhile, investor support for director elections and executive pay programs is holding strong as companies continue to enhance their investor communications—both in the proxy and through direct engagement.

This post is based on the EY Center for Board Matters proprietary corporate governance database and ongoing conversations with investors and directors. [1]

La Banque Royale abolit 450 postes

21 juin 2017

La Presse canadienne, Radio-Canada

La Banque Royale du Canada (RBC) éliminera 450 postes, principalement au sein de son siège social, à Toronto, mais aussi dans d’autres bureaux de la région - le tout afin de moderniser ses installations.

« Nous consolidons (des activités) lorsque c’est nécessaire pour nous permettre de réinvestir dans des secteurs clés, comme le numérique et les nouvelles technologies, ainsi qu’à des endroits où le potentiel de croissance est élevé », a indiqué mercredi une porte-parole, Catherine Hudon, par courriel.

FAIR Canada Submits Brief to Parliamentary Standing Committee on Finance

June 19, 2017

FAIR Canada

FAIR Canada has submitted a brief to the Parliamentary Standing Committee on Finance regarding consumer protection and oversight in Relation to Schedule I Banks. FAIR Canada has been following the CBC Go Public investigation of improper sales practices at Canada’s banks, and like many, is concerned with the allegations made by former bank employees.

FAIR Canada’s Brief highlights factors that have led to an increasing need for objective advice by Canadians as well as the increasing level of trust placed by Canadians in their financial institutions to help them (in their best interests) meet their financial goals. However, it appears that there are firm-wide practices and compensation structures that prevent Canadians from receiving adequate advice including being sold unnecessary products or unsuitable investments that are not in their best interests.

« Les données bancaires de Mark Carney compromises par un […] un employé corrompu de la Banque Royale du Canada » @RBC @RBCfr https://t.co/EUUBiE0pYL pic.twitter.com/rhn8zP9lCd

— Le MÉDAC (@MEDACtionnaires) September 25, 2025

Quelle est la responsabilité des compagnies quant aux déclarations publiques de leurs employés faisant la promotion de la violence? “many […] who cheered the firing of participants in the Jan. 6 […] riots are appalled by dismissals of Kirk’s critics now” https://t.co/BUP56bdRd2

— Le MÉDAC (@MEDACtionnaires) September 22, 2025

Paul-Antoine Jetté, chroniqueur à Sauve qui peut!, animée par @PYMcsween, dresse un portefeuille « équilibré » de FNB indiciels :

— Le MÉDAC (@MEDACtionnaires) September 10, 2025

• 30 % 🇨🇦 : XUS ou VFV

• 30 % 🇺🇸 : XIC ou VCN

• 30 % international avec XEF (ou VIU?)

• 10 % d’obligations 🇨🇦 : XBB ou VABhttps://t.co/8Y6QILL51f

Si tant avait été qu’il eût fallu une métaphore de plus pour illustrer le sentiment des actionnaires éplorés de @LionElectrique. 🔥😢 https://t.co/b9kU2XsqPY pic.twitter.com/rjAPrZk0eb

— Le MÉDAC (@MEDACtionnaires) September 9, 2025

Qui sont les actionnaires de @CoucheTardQc détenant les 111 489 508 actions (14,44 %) votées en faveur d’un vote consultatif annuel sur ses politiques environnementales et les 279 531 760 actions (36,20 %) pour le retour des assemblées en personne? https://t.co/GnWM9R9flG pic.twitter.com/rQFAGRInen

— Le MÉDAC (@MEDACtionnaires) September 8, 2025

A-t-on vraiment besoin de ça, dans une perspective d’investissement (individuel) à long terme, pour la retraite, par exemple? N’est-ce pas plutôt un instrument pour les organisations? https://t.co/kkM86fBkY6

— Le MÉDAC (@MEDACtionnaires) August 26, 2025

La @SECGov publie, dans une (nouvelle) page web, les graphiques des principaux indicateurs statistiques concernant les marchés de capitaux. L’annonce : https://t.co/lqShDaBLWv La page : https://t.co/N28qy1wtVg Un exemple de graphique : pic.twitter.com/8Omu7xjPNb

— Le MÉDAC (@MEDACtionnaires) August 14, 2025

🇺🇸Une étude de la @FINRAFoundation pour l’éducation de l’org. d’autorèglementation du courtage en valeurs mobilières @FINRA dit : les « jeunes investisseurs, en particulier les hommes, sont ouverts à l’idée de recevoir leurs conseils financiers de » l’IA. https://t.co/AQetgKgcrA

— Le MÉDAC (@MEDACtionnaires) July 28, 2025

🇺🇸 Un jugement récent empêchera la @SECGov d’exiger plus de transparence d’@issgovernance et de @GlassLewis. https://t.co/HqShUuxIxL Aussi, retour aux questions de bonne gouverne (gouvernance) et de rémunération traditionnelles. https://t.co/JitpTLcQNe

— Le MÉDAC (@MEDACtionnaires) July 28, 2025

La Governance for Growth Investor Campaign (GGIC), soutenue par @ShareAction, qui regroupe des fonds de pension qui gèrent 150G£ d’actif, réclame de toutes les entreprises du FTSE 100 de tenir des assemblées en personne plutôt que seulement virtuelles. https://t.co/4Rq6COgTnS

— Le MÉDAC (@MEDACtionnaires) July 28, 2025

L’Office d’investissement du régime de pension du Canada (OIRPC) @cppinvestments abandonne son objectif d’atteinte de la carboneutralité en 2050 (net zero), après seulement 3 ans, en l’annonçant dans la section FAQ de son site web. https://t.co/lxMT6ssnF1 https://t.co/1B2LZyT93y pic.twitter.com/ctU3MAF2rW

— Le MÉDAC (@MEDACtionnaires) May 30, 2025

Des investisseurs institutionnels d’importance (950 milliard$ sous gestion) demandent que Musk travaille 40 h/sem. pour Tesla. Ils détiennent 0,25 % des actions de Tesla. https://t.co/ag87Tgkp7I

— Le MÉDAC (@MEDACtionnaires) May 29, 2025

BlackRock parie sur l’intérêt des investisseurs pour le secteur de la défense (en Europe…) en constituant un FNB indiciel. https://t.co/QNey6GoRs2

— Le MÉDAC (@MEDACtionnaires) May 29, 2025

« retirer des sommes de ses comptes de courtage imposables vers des [CELI] en générant ainsi artificiellement des pertes dans les premiers et des gains dans les seconds » — @lautorite https://t.co/gpPQdhi39s

— Le MÉDAC (@MEDACtionnaires) May 29, 2025

« Le remplacement de Bruce Guerriero et de Daniel Rabinowicz est réclamé […] La suppression de la structure à deux catégories d’actions est aussi revendiquée » https://t.co/2C4FI4U2RX

— Le MÉDAC (@MEDACtionnaires) May 23, 2025

Le nombre de propositions d’actionnaire concernant la gouvernance a diminué moins vite que les propositions d’actionnaire sur l’environnement, de 2018 à 2025, aux É.-U.-d’A., selon ISS. Dans l’ensemble, c’est un creux sur 8 ans. https://t.co/dAucnupAPw

— Le MÉDAC (@MEDACtionnaires) May 23, 2025